Dollar ended as the strongest performer last week, boosted by a surge in U.S. Treasury yields following persistent inflation data. Despite expectations of another 25bps rate cut at the upcoming FOMC meeting, stubborn price pressures are likely to slow the pace of policy easing next year. Adding to the caution, inflation uncertainties under the incoming administration’s fiscal and trade policies will keep Fed on guard, discouraging aggressive action. Technically, the Dollar Index’s near-term bullishness remains intact, though another strong rally would hinge on whether 10-year yield can make significant new gains.

Among commodity-linked currencies, both the Australian and Canadian Dollars finished on firm footing. Aussie overcame RBA’s dovish shift, as robust domestic employment data tempered expectations of an early policy cut in February. Similarly, Canadian Dollar found support after BoC delivered a second 50bps rate cut but signaled a more measured approach moving forward. This shift in tone suggests that both central banks are not in a rush to push rates lower and are more inclined to respond thoughtfully to incoming data.

In Europe, Euro stood out, benefiting from the ECB’s modest 25bps rate cut and officials’ commitment to gradualism. By contrast, Swiss Franc lagged, ranking as the second weakest currency after SNB delivered a surprising 50bps reduction, raising the prospect of a return to zero or negative rates if inflation weakens further.

Nevertheless, Yen was the worst performer, weighed down by higher yields in both the US and European markets. Meanwhile, Sterling and New Zealand Dollar found themselves in middle positions.

Hawkish Fed Undertones Emerge, Treasury Yields Soar and Dollar Gains

Last week brought significant surge in US Treasury yields, fueled by consecutive inflation prints that reinforced the persistence of price pressures. Headline CPI rose to 2.7%, marking the second straight monthly re-acceleration, while core CPI held steady at 3.3%. Adding to this inflationary backdrop, PPI hit 4.7%, its highest since February 2023.

Although these figures won’t stop Fed from delivering another 25bps cut at its upcoming meeting, they underscore the likelihood of a “hawkish cut.” Markets now anticipate Fed signaling a pause in January and slowing the pace of rate reductions through 2025.

The need for a measured easing path is becoming increasingly evident. Disinflation has shown little progress in recent months, and inflationary pressures could re-emerge under President-elect Donald Trump’s anticipated fiscal and trade policies, which remain to be fully detailed.

Current market pricing reflects expectations for just two additional rate cuts in 2025, bringing the federal funds rate to 3.75–4.00%, already higher than Fed’s September median projection of 3.4% for year-end 2025. This represents a marked shift from September when markets anticipated a more aggressive easing cycle. The market’s uncertainty, with roughly a third of participants expecting fewer cuts and a third expecting more, highlights the uncertainty around the outlook.

Technically, the strong rebound in 10-year yield not makes the dip to 4.126 a false break of 55 D EMA. The development suggests that rise from 3.603 is still in progress. Retest of 4.505 resistance should be seen next, and firm break there will target 61.8% projection of 3.603 to 4.505 from 4.126 at 4.683.

More importantly, the development in 10-year yield solidifies that case that whole medium term correction from 4.997 has completed with three waves down to 3.603. The strong support from 55 W EMA (now 4.133) also supports this view. There is prospect of resuming the up trend of 0.398 (202 low) through 4.997 to 38.2% projection of 0.398 to 4.997 from 3.603 at 5.359 next year.

Dollar Index followed yields higher last week, and the development suggest that pull back from 108.07 has completed. While the near term corrective pattern could still extend with another falling leg, it’s now looking more likely that downside will be supported by 38.2% retracement of 100.15 to 108.07 at 105.04, which is slightly below 55 D EMA (now at 105.12). Rise from 100.15 should resume sooner or later through 108.07, but that would depends on when 10-year yield would power through 4.505 resistance.

Also, the next rally in Dollar Index through 108.07 would solidify that case of medium term bullish trend reversal. Upside acceleration could follow through 161.8% projection of 99.57 to 107.34 from 100.15 at 112.72.

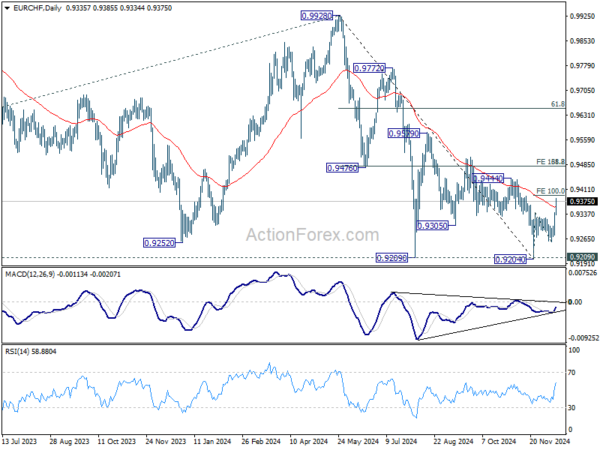

EUR/CHF Rises Sharply Amid SNB’s Bold Cut and ECB’s Gradualism

EUR/CHF climbed significantly, driven by divergent monetary policy decisions from SNB and the ECB. SNB delivered a hefty 50bps rate cut, pushing its policy rate down to 0.50%. This move was accompanied by revised inflation projections, which show inflation staying below the mid-point of SNB’s target range throughout the forecast horizon. While somewhat unexpected, the decision aligns with SNB’s historical pattern of bold actions, necessitated by Switzerland’s unique economic challenges as a small, open economy. The cut also brings Switzerland closer to the prospect of 0% rates and potentially negative territory if deflationary pressures continue to build.

In contrast, ECB implemented a more modest 25bps cut in its deposit rate, bringing it to 3.00%. Euro strengthened in the wake of commentary from ECB officials, who signaled a broad consensus for the gradual approach to easing. Policymakers expressed confidence in inflation returning to target levels without resorting to aggressive rate cuts, even as economic activity data remains weak. ECB’s preference for gradualism signals a desire to balance economic risks without triggering undue market anxiety.

Technically, EUR/CHF’s rebound from 0.9204 resumed with strong acceleration last week. The firm break of 55 D EMA argues that a medium term bottom was already formed. Immediate focus is now on 100% projection of 0.9204 to 0.9343 from 0.9254 at 0.9393. Firm break there will be a strong sign of underlying bullish momentum, and pave the way to 161.8% projection at 0.9479. This level coincides with 38.2% retracement of 0.9928 to 0.9204 at 0.9481. Reaction there would reveal whether the cross is already in medium term trend reversal.

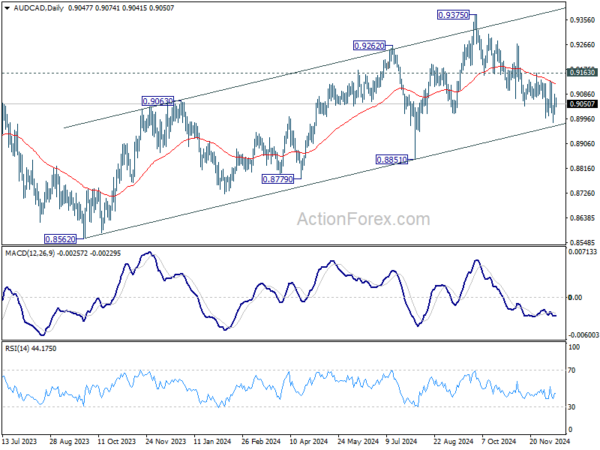

AUD/CAD Stays Indecisively Bearish after RBA and BoC

AUD/CAD remains on the defensive last week following developments in Australia and Canada, even though downside momentum has been indecisive.

RBA’s decision to keep rates unchanged at 4.35% was accompanied by a surprising dovish shift. Key in this shift was the central bank’s move to drop the previously language of “not ruling anything in or out” regarding policy adjustments. This subtle but significant change signals a growing inclination toward rate cuts, contingent on further evidence of sustained disinflation. Governor Michele Bullock, when pressed on the likelihood of a February cut, candidly admitted she does not “actually know”.

However, the case for imminent easing faced a setback with robust labor market data released just two days after the RBA meeting. November’s employment figures exceeded expectations, while unemployment rate fell unexpectedly to 3.9% from 4.1%. The persistently tight labor market could keep RBA cautious about prematurely easing policy.

In contrast, BoC moved decisively with a 50bps rate cut, bringing the overnight rate to 3.25%. This marks the second consecutive 50bps cut, placing policy at the top end of the neutral range. Governor Tiff Macklem signaled a shift toward a more measured easing approach, saying, “With the policy rate now substantially lower, we anticipate a more gradual approach to monetary policy if the economy evolves broadly as expected.” Market expectations for another cut in January stand at 70%, though a pause seems increasingly likely in the near term, as BoC evaluates the impact of its aggressive rate reductions.

Technically, AUD/CAD is now at a juncture. Near term outlook is staying bearish as the cross is held well below falling 55 D EMA. Yet, it’s now in proximity to medium term rising channel support, which could limit downside in case of another fall. Indeed, break of 0.9163 resistance will argue that pull back from 0.9375 has completed, and was merely a correction. Rise from 0.8562 should then be ready to resume. However, sustained break of the channel support will argue that the trend has already reversed.

The pair’s trajectory in the near term hinges on the timing of RBA rate cuts and a BoC pause. Over the medium term, broader macroeconomic factors, including the impact of the US-China tariff war, will likely play a significant role. RBA Deputy Governor Andrew Hauser has just emphasized Australia’s “unique” vulnerability to global trade disruptions due to its heavy reliance on Chinese markets, a risk that could weigh on Australian Dollar further if tensions escalate.

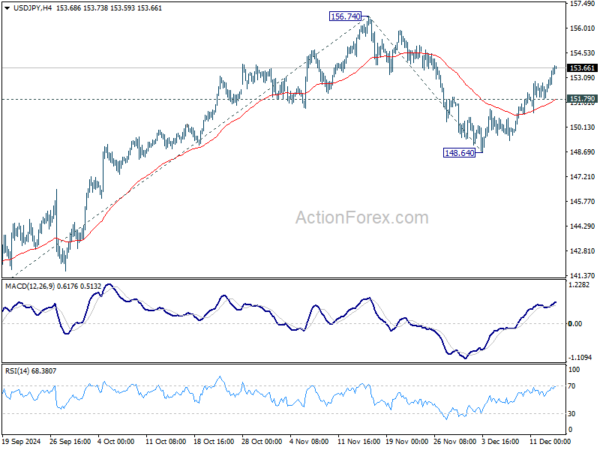

USD/JPY Weekly Outlook

USD/JPY’s stronger than expected rebound last week suggests that correction from 156.74 has completed at 148.64. Initial bias remains on the upside this week for retesting 156.74 first. Firm break there will resume whole rally from 139.57, and target 61.8% projection of 139.57 to 156.74 from 148.64 at 159.25 next. On the downside, below 151.79 minor support will turn intraday bias neutral first. But risk will stay on the upside as long as 148.64 support holds, in case of retreat.

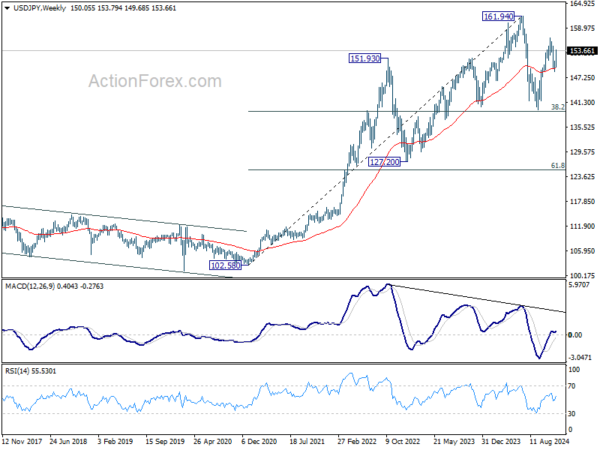

In the bigger picture, price actions from 161.94 are seen as a corrective pattern to rise from 102.58 (2021 low). The range of medium term consolidation should be set between 38.2% retracement of 102.58 to 161.94 at 139.26 and 161.94. Nevertheless, sustained break of 139.26 would open up deeper medium term decline to 61.8% retracement at 125.25.

In the long term picture, it’s still early to conclude that up trend from 75.56 (2011 low) has completed. However, a medium term corrective phase should have commenced, with risk of deep correction towards 55 M EMA (now at 134.98).